Many had expected that Trump’s odd executive orders on unemployment benefits would be a signal for Republicans to give up some of their goals in order to achieve a deal in Congress.

It seems like that hope was misguided. Reports are coming in that the Senate has decided to give themselves a nice summer vacation, instead:

Economic implications

As of this morning’s unemployment report (see attached PDF), there are still more than 28 million Americans receiving state and/or Federal unemployment benefits. Up until the last week or two, recipients were still getting payments padded with the additional Federal subsidy in the amount of $600.

A recent study attempts to examine the effects of the currently expired unemployment benefit, and it provides an alternative scenario where the benefit was reduced from $600 a week to $200. In this analysis, consumer spending dropped by 28% with the $400 reduction in aid.

Right now, the real world situation is significantly worse than that, because unemployed individuals won’t even be receiving the reduced $200 Federal benefit that the study’s authors had calculated for.

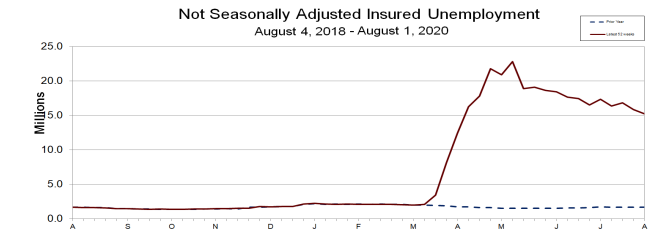

Unemployment remains high

While the number of new claims continues to drop, the number of Americans who are still looking for a job has not declined so quickly:

So in addition to a minimum reduction in consumer spending of 28%, we should probably also expect increased pressure on housing as the rate of mortgage and lease delinquency increases.

These delinquency rates have already begun spiking, so the fact that 28 million Americans just lost $600 a week is certain to make a bad situation worse. And speaking of worse, the impact on real estate seems to be worst in the largest cities. These five, in particular, have short term mortgage default rates well above the national average:

- Miami

- New York

- Las Vegas

- Houston

- Chicago

The economic outlook is grim

While markets have prematurely celebrated and priced in a full recovery, there are multiple warning signs that things are not back to normal – and they’re about to get even worse.